Helping RTOs manage their financial reporting

& completion of the FVRA Tool.

Starting an RTO?

Starting an RTO can be challenging.

You must understand the VET system and submit the Business Plan & Financial Viability Risk Assessment (FVRA) Tool with ASQA as an initial completeness check.

If these documents are incomplete, the ASQA will not commence the assessment process.

We can make this process easier for you by completing the FVRA Tool, which supports the Business Plan, and organising a business structure for the success of your RTO.

Existing RTO?

We use cloud technology like Xero to provide easy-to-access and understand real-time reports, ensuring your RTO is always financially healthy, protected, and ready for growth.

We can also assist your RTO in preparing its next funding application (Skills First/VTG VET, VET Student Loans/VET FEE-HELP, Skills for All, and NSW Smart and Skills).

FVRA Tool

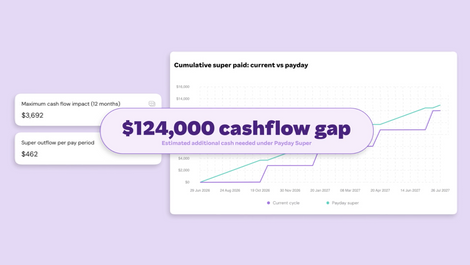

The FVRA Tool spreadsheet is a three-way forecast, a combination of Profit and Loss, Balance Sheet, Cash Flow, and associated information, that enables ASQA to determine whether your RTO can manage a positive cash flow.

When does ASQA require the FVRA Tool?

-

Initial registration for an RTO or CRICOS

-

Changing the scope of an RTO (within two years of registration)

-

A 50% change in ownership within a year

-

When a monitoring review is requested

As a qualified chartered accountant, Shiv can help you prepare and sign off on your FVRA Tool.

About

Shiv Jaidka has 15+ years of experience, specialising in providing accounting and taxation services to RTOS and the VET Industry. A fully qualified chartered accountant who can handle every aspect of your financial reporting and compliance requirements

Case Study

‘I was in the process of setting up my new RTO, and there were many questions in my mind. Shiv helped me put the strategy in the form of a Business Plan to start the conversation with ASQA. He completed the Financial Viability Risk Assessment (FVRA) Tool for submission with ASQA and liaised directly with the consultant organising the registration. Now Clayton Education Group has received the RTO registration; I use and recommend his Business Accounting and Taxation Services as well.'

Ramesh Tanimki

CEO

Clayton Education Group (RTO 45620)