FVRA Tool Resources

It is exciting to share some tips on completing the FVRA Tool that I have learned over time. These tips will help you get an acceptable result. I will talk about financial metrics also listed on the tool's 'Risk Setting & Weightings' tab.

Earnings Before Interest and Taxes (EBIT):

This ratio analyses RTO's operational performance without capital and income tax costs. The purpose is to ensure that the provider can generate enough surplus to sustain the education operations in the long run. The Ratio is calculated by dividing the EBIT by the total revenue. A ratio of .10 or higher is a healthy ratio.

Interest Coverage:

The Ratio calculates how easily an RTO can pay interest on its debts. It is calculated by dividing the EBIT by the Interest expense. The higher the ratio, the better. It would be even better if the RTO could access interest-free director or related party loans.

Employee Costs (Trainer & Admin) to Total Revenue:

Employee cost is significant for an RTO and should ideally be .3 or less of the total revenue.

Debt Ratio:

The debt ratio measures the extent of RTOS's leverage, comparing its debt (excluding related party loans) to its assets. A ratio of .25 or less is a good debt ratio. Again, higher equity contributions or access to related party loans improve this Ratio.

Operating Cash Flow:

This Ratio calculates the RTO liquidity in the short term to ensure that the RTO can generate enough cash to cover its payables (other than the related party loans). This is measured by dividing the cash generated from operations by the payables other than the associated parties. A ratio of 2 or higher is a healthy result.

Book a meeting with me if you need help completing the FVRA Tool or have any questions.

What is the FVRA Tool?

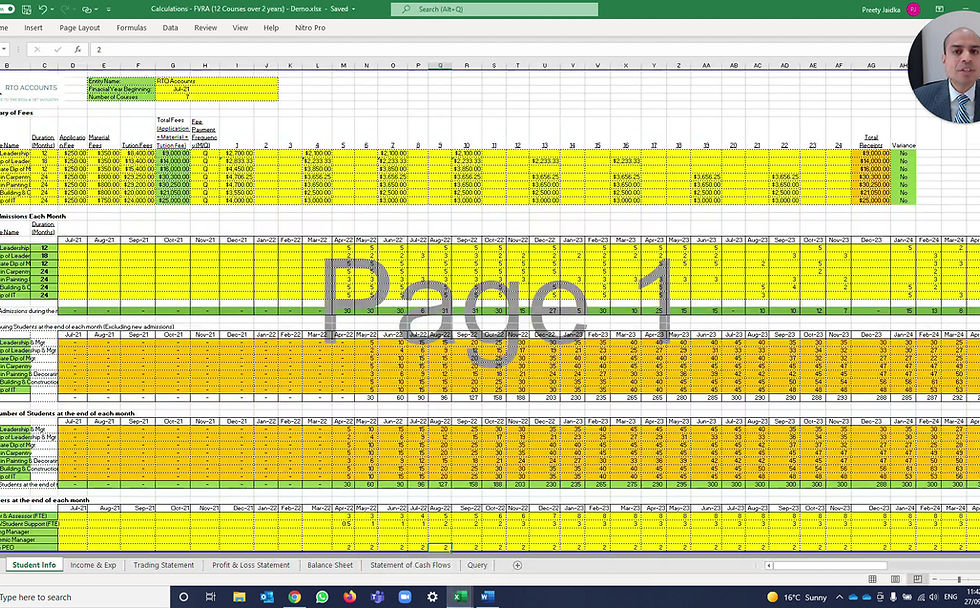

The FVRA Tool ASQA requires eleven macros enabled and locked sheets to assess the financial viability of a new applicant or an existing RTO.

The tool requires you to provide information on your organisation's financial history and projections.ASQA will use this information to calculate ratios and determine your RTO's financial health.

It also requires non-financial information, such as projected student and staff numbers. Before submission, the tool provides results in traffic light signals to indicate whether the base financial requirements have been satisfied or if further assessment is required.

The tool requires supporting evidence to ensure that the data is correct. The tool needs to be prepared and signed off by a qualified accountant.

Having completed many FVRA Tools for RTOS, I understand the requirements for an acceptable result. I will discuss this in more detail in the following video.

Book a meeting with me if you need help or have any questions.

Completing the FVRA Tool

The approach RTO Accounts uses to complete the FVRA Tool.

Book a meeting with me if you need help completing the FVRA Tool or have any questions.